Oleh Dr. Sufian Jusoh

sufianjusoh@gmail.com

PENULIS ialah Perunding Perbadanan Harta Intelek Malaysia berkaitan Penilaian Harta Intelek.

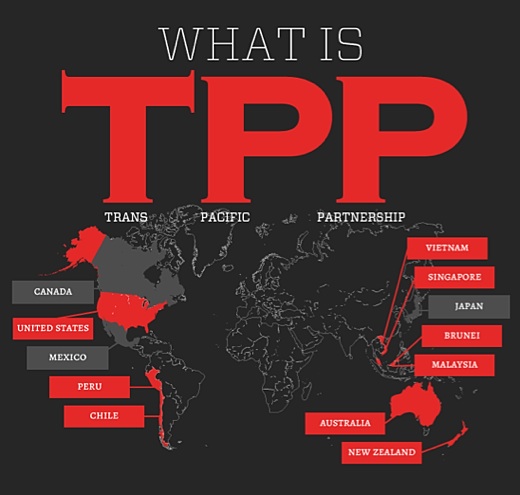

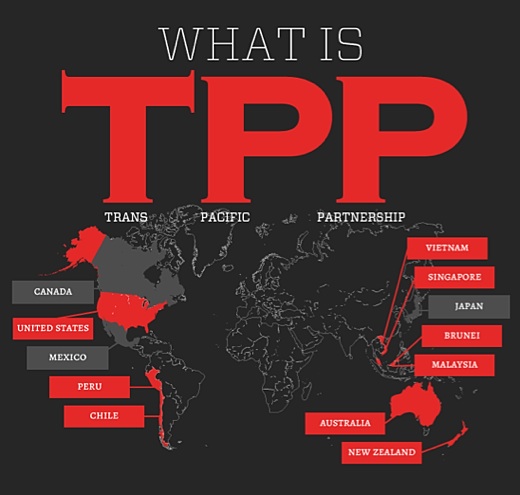

Terdapat beberapa perkara yang perlu dijelaskan kepada masyarakat umum tentang Perjanjian Perdagangan Bebas (FTA) yang antara lainnya, Perjanjian Perkongsian Trans-Pasifik (TPP) supaya masyarakat dapat memahami sama ada terdapat faedah dan pengajaran yang boleh diperolehi. Apa itu FTA; apakah FTA yang telah ditandatangani dan sedang dirundingkan oleh Malaysia; apa itu TPP; dan peluang serta kesan FTA kepada Malaysia terutamanya kepada usahawan Melayu dan Bumiputera.

Perjanjian Perdagangan Bebas (FTA)

FTA merupakan satu perjanjian perdagangan di antara dua buah negara atau beberapa negara yang berkaitan dengan perdagangan. FTA wujud apabila negara-negara terbabit membuat perjanjian bagi pengurangan 'tariff' atau dirujuk sebagai duti import terhadap barang dari negara yang menjadi ahli kepada perjanjian terbabit.

FTA juga selalunya melibatkan pengurangan kuota import dan memberi beberapa kelebihan kepada barangan yang diimport dan memenuhi syarat-syarat FTA yang berkaitan. Bentuk perjanjian FTA ini telah melalui beberapa generasi.

Generasi pertama FTA biasanya cuma merujuk kepada perdagangan barangan dua hala atau serantau, manakala generasi terbaru FTA melibatkan isu-isu lain yang berkaitan seperti import dan eksport perkhidmatan, hal-hal berkaitan harta intelek, pergerakan sementara tenaga kerja terutamanya berkaitan dengan tenaga pakar, pengurusan kanan dan lembaga pengarah, dan yang terbaharu adalah hubung kait di antara perdagangan barangan dan perkhidmatan dengan pelaburan.

Terdapat juga beberapa FTA yang mempunyai peruntukan bukan tariff seperti standard dan peraturan berkaitan dengan keselamatan makanan, perdagangan elektronik dan juga kontrak bekalan kerajaan (government procurement atau GPA).

Semua FTA yang ditandatangani oleh ahli Pertubuhan Perdagangan Dunia (WTO) hendaklah didaftarkan dan perlu memenuhi syarat-syarat yang telah ditetapkan oleh WTO.

FTA yang telah ditandatangani dan sedang dirundingkan oleh Malaysia

TPP bukanlah satu-satunya FTA yang sedang dirundingkan dan akan ditandatangani oleh Malaysia. Perlu diingatkan bahawa Malaysia adalah ahli kepada beberapa pertubuhan yang menganjurkan perdagangan bebas sama ada secara pelbagai hala atau serantau seperti WTO dan ASEAN.

WTO adalah suatu pertubuhan perdagangan bebas terpenting di dunia dan Malaysia adalah ahli asal sejak penubuhan WTO pada tahun 1995. Selain itu, Malaysia juga adalah pendokong kuat perjanjian-perjanjian di bawah ASEAN yang membentuk sebahagian daripada Komuniti Ekonomi ASEAN (AEC) iaitu Perjanjian ASEAN Berkaitan Perdagangan Barangan (ATIGA), Rangka Perjanjian ASEAN Berkaitan Perkhidmatan (AFAS) dan Perjanjian Komprehensif Pelaburan ASEAN (ACIA).

Selain daripada itu, Malaysia juga merupakan sebahagian daripada APEC yang antara lain, menganjurkan kerjasama perdagangan di antara negara-negara anggota.

Antara lain, Malaysia juga telah menandatangani FTA dengan Jepun, Pakistan, India, Chile, New Zealand, Australia dan melalui ASEAN telah menandatangani FTA dengan Australia, New Zealand, Korea, China, India dan Jepun. Malaysia juga sedang berunding untuk mengadakan FTA dengan Kesatuan Eropah dan Turki.

Apakah TPP?

TPP bukanlah suatu FTA yang baru. TPP dalam bentuk yang dirundingkan sekarang adalah satu kelangsungan daripada rundingan TPP yang bermula dari tahun 2005, yang ditandatangani oleh Brunei Darussalam, Chile, New Zealand dan Singapura. Negara-negara asal perjanjian itu pada ketika itu, telah bersetuju untuk mengembangkan ruang lingkup perjanjian dan juga 'keahlian' kepada beberapa negara jemputan seperti Australia, Malaysia, Peru, Vietnam, Amerika Syarikat (AS), Mexico dan Kanada.

Terdapat banyak negara yang berminat untuk menyertai rundingan TPP tersebut. Yang menariknya, Jepun telah mengadakan satu pilihan raya untuk menentukan mandat negara tersebut untuk menyertai perjanjian ini dan khabarnya Jepun akan menyertai rundingan TPP ini pada bulan Julai nanti yang akan berunding di Kuala Lumpur.

Perjanjian ini merupakan satu rundingan yang melibatkan pelbagai negara dan bukan merupakan perundingan di antara Malaysia dan AS semata-mata. Rundingan tersebut melibatkan negara-negara yang telah pun mempunyai FTA sesama mereka.

Sebagai contoh, Malaysia telah pun mempunyai FTA dengan Chile, New Zealand, Jepun dan Australia. Manakala Malaysia sebagai salah satu daripada negara ASEAN juga mempunyai perjanjian perdagangan dengan Brunei, Vietnam dan Singapura.

Malaysia dan AS telah cuba berunding untuk mengadakan satu FTA tetapi telah terbantut kerana beberapa isu sensitif yang tidak dapat diselesaikan pada ketika itu, seperti isu harta intelek dan juga kontrak bekalan kerajaan atau GPA.

Secara keseluruhan, TPP sebagai sebuah perjanjian dijangka mencakupi pelbagai isu, seperti perdagangan barangan, perdagangan perkhidmatan, alam sekitar serta kelestarian sejagat, GPA, harta intelek, pelaburan dan bantuan teknikal.

Negara-negara yang menyertai rundingan TPP diberi kebebasan untuk menyenaraikan peraturan dan polisi yang tidak boleh dipatuhi sebagai sebahagian daripada perjanjian. Perlu juga diingat bahawa rundingan masih lagi berjalan dan apa yang nyata, kita perlu yakin bahawa pegawai Malaysia yang menyertai rundingan ini adalah berpengalaman, terlatih dan memahami isu yang berkaitan dengan kepentingan Malaysia.

Peluang dan Kesan FTA dan TPP kepada Usahawan Melayu/Bumiputera

Terdapat beberapa isu yang telah diperkatakan oleh pihak berkenaan dengan kesan FTA dan TPP kepada usahawan Melayu dan Bumiputera di Malaysia. Kebanyakan kenyataan berhubung dengan perkara ini dibuat berdasarkan kepada persepsi semata-mata, tanpa bersandarkan kepada fakta ilmiah dan realiti. Beberapa isu berkaitan akan dibincangkan di bawah.

a. Hakcipta

Antara isu berkaitan harta intelek yang dirundingkan di bawah mandat TPP ialah berkaitan dengan tempoh masa hakcipta dan paten. Terdapat cadangan dari beberapa negara yang menyertai rundingan TPP tersebut untuk melanjutkan tempoh hak cipta 70 tahun selepas kematian pemegang hak cipta tersebut.

Sekiranya kita hanya melihat kepada sebelah pihak, semestinya kita akan berpandangan bahawa hak cipta tidak sepatutnya dilanjutkan tempoh perlindungannya kepada satu tempoh yang lama sehingga 70 tahun selepas kematian pemegang hak cipta asal tersebut.

Ini kerana kadar import harta intelek Malaysia adalah diperkatakan akan melebihi dari kadar harta intelek yang dijana di dalam negara atau yang dieksport keluar.

Bagaimanapun, adalah dasar kerajaan untuk menggalakkan perkembangan industri berasaskan pengetahuan dan inovasi seperti industri kreatif, perisian, penulisan buku dan lain-lain aktiviti yang berkaitan. Hak cipta merupakan sebahagian daripada usaha untuk memberi pengiktirafan kepada bakat di dalam negara.

Justeru, usahawan Melayu dan Bumiputera yang bergiat dalam industri kreatif dan yang berkaitan dengannya, perlu diberi pengiktirafan sewajarnya seperti diberi tempoh hak cipta yang lebih panjang. Sekiranya tempoh masa lebih panjang diberikan di bawah TPP, usahawan Melayu dan Bumiputera akan mendapat perlindungan harta intelek bukan sahaja di Malaysia tetapi juga untuk tempoh masa yang sama, di negara-negara anggota TPP juga.

Pengiktirafan dalam bentuk hak cipta yang lebih lama akan memastikan cerdik pandai Melayu akan kekal bergiat cergas di Malaysia dan tidak perlu berhijrah ke luar negara semata-mata untuk mengembangkan bakat mereka.

Bersambung Esok

Artikel Penuh: http://www.utusan.com.my/utusan/Rencana/20130621/re_02/Apa-faedah-Perjanjian-Perkongsian-Trans-Pasifik-kepada-usahawan-Melayu#ixzz2Wo36ZVLN

© Utusan Melayu (M) Bhd